Edgar de Wit

Edgar de Wit

Driver-based models are widely discussed in finance. Volumes, capacity, staffing levels, and operational assumptions already appear in many budgets and forecasts. Even so, many finance teams struggle to make these models reliable and repeatable beyond a single planning cycle. Most teams understand how volumes affect revenue or how staffing levels drive costs - the difficulty emerges when models are expected to scale, support change, and remain credible over time.

Driver-based modelling works best when it is treated as a structured way of connecting operations and finance, rather than as a set of calculations built for a specific moment. This article explores the components that support that structure and explains why many driver-based models feel fragile in practice.

Driver-based models rely on consistency; when the underlying structure changes frequently, even well-designed drivers lose their effectiveness.

Key elements of that structure include:

Many teams begin modelling drivers while these elements are still evolving. Accounts are added or renamed, locations are reorganised, and reporting dimensions differ across teams. Each change introduces uncertainty and requires manual adjustments. Over time, this erodes confidence in the model. Discussions shift from business assumptions to structural corrections, making it harder to rely on the outcomes.

Drivers are often mistaken for KPIs or derived metrics. Effective driver-based models rely on a small number of operational levers that teams can influence directly.

These drivers tend to:

The choice of drivers depends on the sector. In manufacturing environments, volumes, yields, and machine hours shape most outcomes. In restaurants or catering, covers, average spend, and wage ratios play a central role.

Adding more drivers often makes a model harder to understand without adding insight. Working with a small number of drivers helps teams make clearer assumptions and have better discussions.

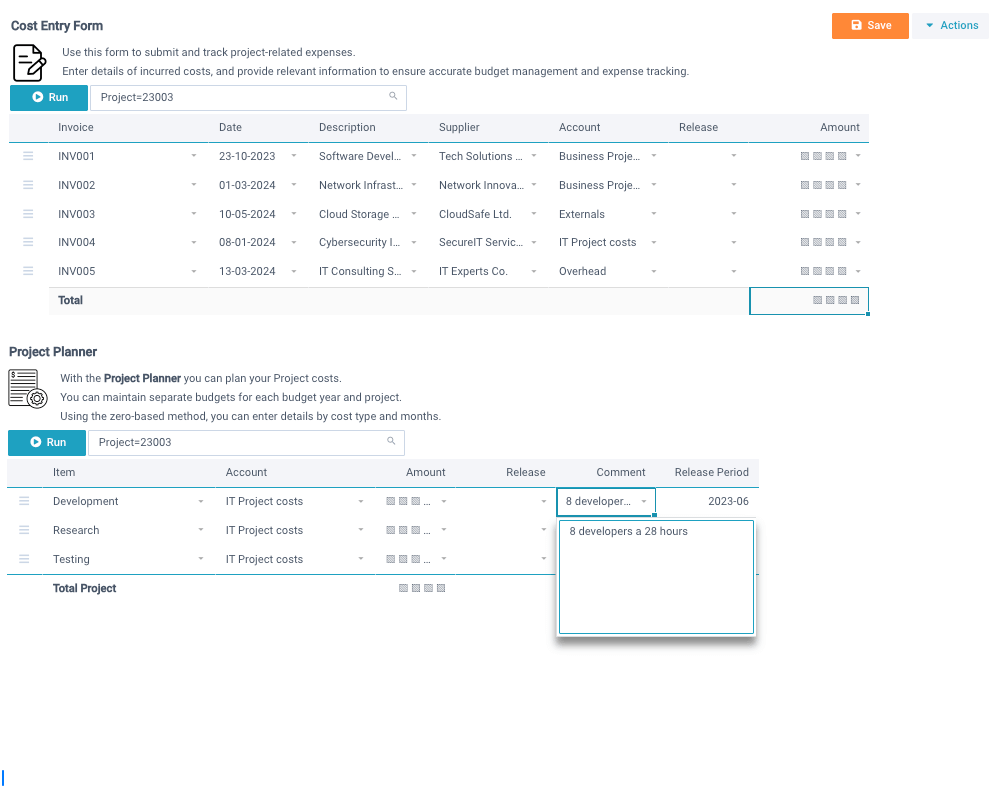

Drivers only become meaningful when their financial impact is made explicit. This translation layer is where operational assumptions connect to financial outcomes, like for example:

Your colleagues might align on operational assumptions but interpret financial consequences differently. This inevitably creates room for debate and confusion. Clear translation logic provides a shared reference point between finance and operations and supports a more consistent interpretation of results.

Driver-based models are often introduced with growth in mind. Over time, organisations add locations, adjust capacity, or explore alternative scenarios. These changes place pressure on the underlying model.

Models that cope well with change tend to rely on shared templates rather than one-off builds, central definitions instead of local variations and consistent logic across entities.

When models are copied and adapted per entity, complexity increases quickly. Maintenance effort grows, and differences between versions become harder to track. Reuse supports continuity and helps models evolve without constant rebuilding.

Governance plays a decisive role in how driver-based models are used. Without clear rules, even well-structured models lose credibility.

Relevant questions include who is allowed to adjust drivers, who validates assumptions and what is fixed after approval. When these boundaries are unclear, discussions drift towards negotiation. Assumptions change late in the process, ownership becomes diffuse, and, of course, this results in a lack of trust in the numbers. We want to focus on decisions rather than disputes.

Most businesses already work with drivers in some form. The gap usually sits in structure, consistency, and ownership rather than in technical capability. If this perspective triggers recognition, it may explain why existing models feel harder to maintain than expected.

If you want to see how these building blocks come together in a working environment, take a Demo Tour and explore how structured driver-based models support planning and decision-making in practice.

Back to the listSchedule a Meeting with one of our Planning and Reporting Experts.

Let's Talk